Knowing when to invest is one of the hardest decisions an investor needs to make in market conditions such as these.

With the C2 Gateway Hindsight Series, you can invest knowing that your Starting Level will be the lowest daily closing price (from a choice of indices) on any particular day in the 6 months following the Commencement Date of the Investment.

The Hindsight Feature of the Investment takes out some of the guess work of working out the “best time to buy”. While the common saying that “time in” the market is better than “timing” the market is often very true, if you can time the entry, it can be very helpful.

Speak with us today about investing with C2 Gateway Hindsight Series

Find out more about C2 Gateway Hindsight Series

Complete the form below and we'll be in touch as soon as possible.

Choose from two underlying Reference Assets

C2 Gateway Series 6 Hindsight

The Citi Radar 5 Excess Return Index.*

*more info at https://investmentstrategies.citi.com/indice/CIISRAD5/12/2

C2 Gateway Series 7 Hindsight

An equal weighted exposure to the S&P ASX200 Price Return Index (Australian shares) and the S&P 500 Price Return Index (USA Shares)**.

**more info at https://au.spindices.com/indices/equity/sp-asx-200 and https://us.spindices.com/indices/equity/sp-500

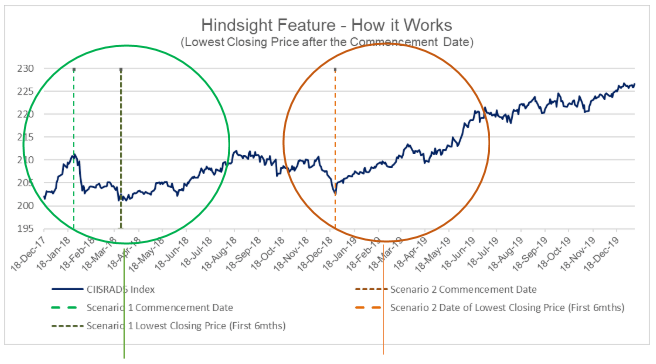

How Does the Hindsight Feature Work?

The Hindsight Feature will automatically record the lowest daily Closing Price of the Reference Asset in the first six months following the Commencement Date of the Investment (the “Hindsight Dates”). This Lowest Closing Price will become the Starting Price by which returns on the Units (in the form of Coupons) will be calculated. This feature helps take some of the guess work out of when to buy, particularly in volatile market conditions.

| Scenario 1 | Scenario 2 |

| Assume a Commencement Date of 25 January 2018 and the Reference Asset closed at 210.36. Over the following 6 months the Reference Asset fell, and the Lowest Closing Price was 201.13 on 26 March 2018. This would be the Initial Starting Price for the calculations of Coupons. | Assume a Commencement Date of 24 December 2018 and the Reference Asset closed at 202.57. Over the following 6 months the Reference Asset was never lower. As such, and so the Lowest Closing Price was 202.57 on 24 December 2018. This would be the Initial Starting Price for calculations of Coupons. |

Speak with us today about investing with C2 Gateway Hindsight Series

Looking for tax certainty?

ATO Product Ruling PR 2020/2 Income tax: taxation consequences of investing in C2 Gateway Deferred Purchase Agreement provides certainty as to the tax outcomes for both Series.

Key Features

With a benefit of a 100% LVR Limited Recourse Loan, your only cash outlay at risk is your interest expense that you pay at Commencement.

Series 6Citi Radar 5 Excess Return Index |

Series 7Equal weighted basket of the S&P ASX200 & S&P500. |

|

| 100% LVR, Limited Recourse Loan | Yes | Yes |

| Interest Rate Payable | 3.00%pa, 4 years payable upfront | 6.00%pa, 5 years payable upfront |

| Term | 4 Years | 5 Years |

| Hindsight Feature Included | Yes | Yes |

| Coupons | Yes, capped at 4.5% in the first 3 years, uncapped Final Coupon at Maturity | Yes, one Final Coupon due at Maturity. |

| Application Fee | $0 | $0 |

| Ongoing Fees | $0 | $0 |

| Performance Fee | 10% | 10% |

| Liquidity | Monthly, or at the Issuers discretion | Monthly, or at the Issuers discretion |

| Minimum Investment | $6,000 cash outlay (provides a $50,000 Limited Recourse Loan for 4 years) | $15,000 cash outlay (provides a $50,000 Limited Recourse Loan for 5 years) |

| Credit Criteria | None | None |

| Margin Calls | No | No |

| SMSFs Eligible | Yes | Yes |

| ATO Product Ruling | Yes, PR 2020/2 | Yes, PR2020/2 |

Speak with us today about investing with C2 Gateway Hindsight Series

Key Risks

- Your return (including any Coupons) is affected by the performance of the Reference Asset(s) for each Series. There is no guarantee that the Reference Asset(s) will perform well.

- No Coupons will be payable if the performance of the Reference Asset is negative at the relevant Coupon Determination Date, or the performance of the Reference Asset is not higher than the sum of any Coupons already paid.

- There is no guarantee that the Units will generate returns in excess of the Prepaid Interest and any Fees, during the Investment Term and you could lose some or all of your Prepaid Interest and any Fees paid at Commencement. Additionally, in the event of an Investor requested Issuer

- Buy-Back or Early Maturity Event, you will not receive a refund of your Prepaid Interest or Fees.

Gains (and losses) may be magnified by the use of a 100% Loan. However, note that the Loan is a Limited Recourse Loan, so you will never lose more than the Prepaid Interest and any Fees paid at Commencement. - Investors are subject to counterparty credit risk with respect to the Issuer and the Hedge Counterparty;

- Gains and losses may be magnified by the use of a 100% limited recourse Loan; and

the Units may mature early following an Early Maturity Event, including an Adjustment Event, Market Disruption Event or if the Issuer accepts your request for an Issuer Buy-Back.

Please refer to Section 2 "Risks" of the Master PDS and to the Reference Asset "Plain English Risk Factors" guide published by Citi at https://investmentstrategies.citi.com for more information on the Series 6 Reference Asset.

Speak with us today about investing with C2 Gateway Hindsight Series

Disclaimer

Units in C2 Gateway Series 6 & & - Hindsight are is issued by C2 Specialist Investments Pty Ltd (ACN 622 433 032) (“the Issuer”) and arranged by C2 Financial Services Pty Ltd (AFSL: 502171. ACN 621 428 635) (“the Arranger”) pursuant to Section 911A(2)(b) of the Corporations Act. Investments in the C2 Gateway Series 6 & 7 – Hindsight can only be made by completing an Application Form attached to the Term Sheet Product Disclosure Statement (“TSPDS”), after reading the Term Sheet PDS dated 15 April 2020 and the Master PDS dated 25 March 2020 and submitting it to the Issuer. A copy of the PDS can be obtained by contacting C2 Specialist Investments on 02 8098 0300 or contacting your financial adviser. You should consider the Term Sheet in the Master PDS’ before deciding whether to invest in Units in C2 Gateway Series 6 & 7 - Hindsight. Capitalised terms have the meaning given to them in Section 10 “Definitions” of the Master PDS or in the TSPDS. This information has been prepared by the Issuer for general promotional purposes only and is not an offer to sell or solicitation to buy any financial products. This information does not constitute personal advice and has been prepared without taking into account your objectives, financial situation or needs. You should consider obtaining professional advice as to whether this financial product suits your objectives, financial situation or needs before investing. You should seek independent advice in relation to the tax implications of your investment. The Issuer may, in its discretion, extend or shorten the Offer Period for the Units without prior notice. If this happens, the Commencement Date and one or more consequential dates for the Units may vary. The Issuer may also defer the Commencement Date for the Units, in which case the Maturity Dates and other consequential dates for the Units may vary. If the Issuer varies the Offer Period or the Commencement Date for the Units it will post a notice on this website.

Past Performance Disclaimer

Past Performance is not indicative of likely future performance. Future returns should be expected to vary and may be negative.

Historical information for the Series 6 Reference Asset illustrated on this website has been provided by the Issuer to potential investors for educational purposes only, to show investors the history of the Reference Asset. The Reference Asset has been live since 20 February 2019. For the period prior, 2 Jan 2003 to 20 February 2019 a simulation was used by Citigroup.

Data for all charts, graphs and tables are as of 1 April 2020. Simulated past performance (back-tested) data from 1 February 2003 to 19 February 2019. Live performance of Citi RADAR 5 Excess Return Index since 20 February 2019. Simulated and live past performance data are provided for illustrative purposes only. Simulated and live past performance data should not be regarded as an indication of future results. Reference Asset performance takes into account deductions for fees and/or costs as specified in the Reference Asset’s index methodology.

Limitations of Simulated (Back-Tested) Performance Information for Series 6.

Index performance date is live for the period 20 February 2019 to 1 April 2020. All Index performance data prior to 20 Feb 2019 is hypothetical and back tested, as the Index did not exist prior to that date. Hypothetical back tested Index performance data is subject to significant limitations. The Index Administrator developed the rules of the Index with the benefit of hindsight that is, with the benefit of being able to evaluate how the Index rules would have caused the Index to perform had it existed during the hypothetical back tested period. The fact that the Index generally appreciated over the hypothetical back tested period may not therefore be an accurate or reliable indication of any fundamental aspect of the Index methodology. Furthermore, the hypothetical back tested performance of the Index might look different if it covered a different historical period. The market conditions that existed during the hypothetical back tested period may not be representative of market conditions that will exist in the future In addition, the sectors tracked by the equity sector ETFs have been modified in important ways during the hypothetical back tested period As a result, the hypothetical back tested performance of the Index may not reflect how the Index would have performed had the sectors tracked by the equity sector ETFs during the back tested period been defined in the way they are currently defined. It is impossible to predict whether the Index will rise or fall In providing the hypothetical back tested and historical Index performance data above, no representation is made that the Index is likely to achieve gains or losses similar to those shown In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular investment. One of the limitations of hypothetical performance information is that it did not involve financial risk and cannot account for all factors that would affect actual performance The actual future performance of the Index may bear no relation to the hypothetical back tested or historical performance of the Index.

Reference Asset Disclaimers

Citi is a registered trademark and service mark of Citigroup Inc. or its affiliates and is used and registered throughout the world. C2 Gateway Series 6 - Hindsight (“the Units”) are not sponsored, endorsed, sold or promoted by Citigroup, and Citigroup makes no representation regarding the advisability of investing the Units. Citigroup gives no express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use. In no event shall Citigroup be liable for any direct, indirect, special or consequential damages in connection with any use of the Citigroup data and information.