Accumulator Series 1

C2 Accumulator - Series 1 matured on 20 Sept 2020 and returned 13.50% to investors over 18 months.

C2 Accumulator Series 1 - Description

C2 Accumulator is a Series of Units which offer Investors the potential to receive fixed growth returns, linked to a basket of the big four Australian bank shares.

The “Reference Asset” is comprised of a notional share in each of:

- ANZ Banking Corporation; and

- Commonwealth Bank; and

- Westpac Banking Corporation; and

- National Australia Bank

(Individually, a “Share”)

C2 Accumulator Series 1 may appeal to Investors who:

- Have a view that none of the Shares will fall by 25% or more at the end of the 5 year Series duration;

- Want an investment with the potential to pay a 9.0% p.a. Coupon for each full year that’s passed (on an non-compounded, pro rata basis), paid on the first Auto Call Date that ALL the Shares are above their respective Auto Call Levels. The first Auto Call Date is at the end of 6 months after the Commencement Date and then every 6 months thereafter until Maturity;

- Are comfortable with the risk that they will have exposure to the Share with the lowest percentage return (“Worst Performing Share”)at Maturity if a Knock-in Event occurs and no Auto Call Event has occurred.

Please refer to section 1 in the Term Sheet PDS for a description of Auto Call Event, Knock-in Event, and a list of all Auto Call Dates.

C2 Accumulator offers some protection from a falling market, but they are not capital protected. The Final Value will be at least equal to the Initial Issue Price as long as the Worst Performing Share has not fallen by 25% or more since the Commencement Date (75% of its Starting Price). However, you will incur a loss at Maturity if just one of the Shares in the Reference Asset has fallen by 25% or more since the Commencement Date (a “Knock-in Event”).

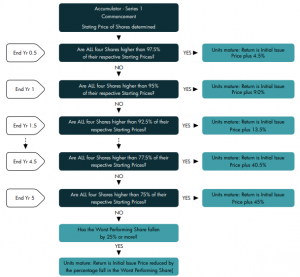

There are two outcomes that Investors may achieve during the Investment Term, depending on the performance of the Shares in the Reference Asset:

1. Investment Gains (an Auto Call Event occurs):

on an Auto Call Date (commencing at the end of year one and then every 6 months thereafter until Maturity), provided ALL the Shares are above the Auto Call Level, the Final Value will be equal to the Initial Issue Price plus the Series Return. For example, if an Auto Call Event did not occur until Year 5, the Investor would receive a Delivery Parcel with a value equal to a Final Value of $1.45 per Unit and the investment would mature ($1.00 + ($1.00 x (9.0% x 5 years passed)).

2. Loss of Capital (no Auto Call Event occurs, and a Knock-in Event occurs at Maturity):

where an Auto Call Event has not occurred during the Investment Term, the Investment reaches Maturity and the Worst Performing Share has fallen by 25% or more (75% or less of its Starting Price), then Investors will be exposed to the negative performance of the Worst Performing Share in the Reference Asset (a “Knock-in Event”). The Final Value will be a portion of the Initial Issue Price (regardless of the actual Issue Price at which the Investor acquired the Units) reflecting the negative performance of the Worst Performing Share in the Reference Asset i.e. the Final Value per Unit will be equal to:

$1.00 x Closing Price (Worst Performing Share) / Starting Price (Worst Performing Share).

Importantly, the Series Return amounts will NOT be included in the Final Value if a Knock-in Event occurs at Maturity.

Find out more about C2 Structured Investments

Complete the form below and we'll be in touch as soon as possible.

Subcribe to our monthly newsletter

Covering important superannuation, SMSF, and investment markets commentary