C2 Gateway Series 34

C2 Gateway Series 34, gives investors the ability to gain leveraged exposure to the performance of the BNP Paribas Multi Asset Diversified 5 Index (the ‘Reference Asset”) over the 4 year Term, with a 100% Limited Recourse Loan at an Interest rate of only 1.99%p.a.

C2 Gateway Series 34 - Performance

* Indicative Unit Price: Investors, please note this is a theoretical Unit Price, assuming that the Units had reached Maturity. This investment is designed to be held to Maturity. Any investors seeking to redeem prior to Maturity may receive an amount significantly different to the Indicative Unit Value stated. Please refer to the PDS for more information about the value of the investment prior to Maturity.

C2 Gateway Series 34 - Description

C2 Specialist Investments allows investors to access investment strategies and structures not readily available to retail investors in Australia. These types of investments are often known as “structured products” and are designed to facilitate highly customised risk return objectives.

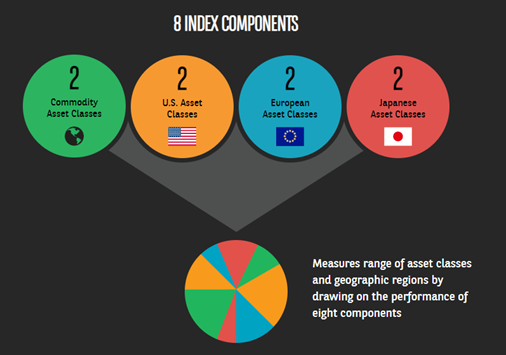

The Units in C2 - Gateway - Series 34 (“Series 2 Units”) offer investors the ability to gain exposure to the performance of the BNP Paribas Multi Asset Diversified 5 Index (the “Reference Asset”). The Reference Asset is a rules-based index with a diversified global exposure (US, Europe, Japan). The Reference Asset measures a range of asset classes and geographic regions by drawing on the performance of eight components including global equities, global bonds and commodities.

Additionally, the C2 - Gateway - Series 34 Units offer:

- The ability to borrow 100% of the investment amount via a Limited Recourse Loan, at competitive interest rates of 1.99% p.a.

- Four potential Performance Coupons at the end of Year 1, Year 2, Year 3 and Maturity (subject to the Performance of the Reference Asset, a 10% Performance Fee).

A summary of the key features are as follows

| Series 34 | |

|---|---|

| Reference Asset | BNP Paribas Multi Asset Diversified 5 Index |

| Currency Exposure | USD on Performance Coupons only (AUD settled) |

| Loan | Yes, 100% Loan (Limited Recourse) |

| Annual Interest Rate on Loan | 1.99% p.a. |

| The Potential for 4 Coupons | Four potential Performance Coupons at the end of Year 1, Year 2, Year 3 and Maturity (subject to a 10% Performance Fee). |

| Margin Calls | No |

| SMSF Eligibility | Yes |

The Reference Asset

The BNP Paribas Multi Asset Diversified 5 Index is a rules-based index with a diversified global exposure (US, Europe, Japan). The Reference Asset measures a range of asset classes and geographic regions by drawing on the performance of eight components including global equities, global bonds and commodities.

Detailed information regarding the Reference Asset may be found at https://madindex.bnpparibas.com/

Find out more about C2 Structured Investments

Complete the form below and we'll be in touch as soon as possible.

C2 Gateway Series 34 - Key Dates

| Timeline1 | |

| Issue Date | 4 October 2021 |

| Commencement Date for exposure to the Reference Asset | 5 October 2021 |

| First Performance Coupon Determination Date at end of Year 1 | 3 October 2022 |

| Second Performance Coupon Determination Date at end of Year 2 | 2 October 2023 |

| Third Performance Coupon Determination Date at end of Year 3 | 1 October 2024 |

| Fourth Performance Coupon Determination Date at end of Year 4 | 6 October 2025 |

| Maturity Date | 6 October 2025 |

1 As advised in your Confirmation Notice. This Timeline is indicative only and changed from the from the Dates in the Term Sheet PDS. The Issuer may, in its discretion, extend or shorten the Initial Offer Period for a Series without prior notice. If this happens, the Commencement Date and one or more consequential dates for the Series may vary. The Issuer may also defer the Commencement Date for a Series, in which case the Maturity Date and other consequential dates for the Series may vary. If the Issuer varies the Initial Offer Period, the Commencement Date, Coupon Dates or Maturity Date for a Series it will post a notice this website. If a date set out in the table above is not a Business Day, then the relevant date will be the next following Business Day.

Find out more about C2 Structured Investments

Complete the form below and we'll be in touch as soon as possible.

C2 Gateway Series 34 - Key Risks

Key risks include

- There will be no Performance Coupons payable if the performance of the relevant Reference Asset during the period is negative, or not greater than the sum of the previous Gross Performance Coupons already paid.

- The Performance Coupons are subject to movements in the AUD/USD exchange rate.

- There is no guarantee that the Units will generate returns in excess of the Prepaid Interest and any Application Fee (if any) during the Investment Term. You could lose some or all of your Prepaid Interest and any Application Fee (if any) paid during the Investment Term. Additionally, in the event of an Investor requested Issuer Buy-Back, you will not receive a refund of your Prepaid Interest or Application Fee (if any), nor will you be entitled to any future Performance Coupons.

- Gains (and losses) may be magnified by the use of a 100% LVR Investment Loan. However, please note that the Investment Loan is a limited recourse loan, so, in respect of the Investment Loan, you will never lose more than the Prepaid Interest and any Application Fee (if any).

- The Units are designed to be held to Maturity. If Investors elect an Issuer Buy-Back, Investors are not entitled to a refund of any Prepaid Interest or any Fees, and may receive substantially less than their Prepaid Interest and any Fees paid at Commencement and the buy-back price may be nil. However, there will never be a liability owing by the Investor, as the Loan limited recourse

- Investors are subject to counterparty credit risk with respect to the Issuer and the Hedge Counterparties.

- The Units may mature early following an Early Maturity Event, including an Adjustment Event, Market Disruption Event or if the Issuer accepts your request for an Issuer Buy-Back.

Please refer to Section 2 "Risks" of the Master PDS for a more comprehensive overview of the Risks. Also refer to the Reference Asset website for more information on specific risks related to the Reference Asset:

https://madindex.bnpparibas.com/Index

Find out more about C2 Structured Investments

Complete the form below and we'll be in touch as soon as possible.

C2 Gateway Series 34 Literature

Find out more about C2 Structured Investments

Complete the form below and we'll be in touch as soon as possible.

C2 Gateway Series 34 - Disclaimer

Units in C2 – Gateway – Series 34 are is issued by C2 Specialist Investments Pty Ltd (ACN 622 433 032) (“the Issuer”) and arranged by C2 Financial Services Pty Ltd (AFSL: 502171. ACN 621 428 635) (“the Arranger”) pursuant to Section 911A(2)(b) of the Corporations Act. Investments in the C2 – Gateway – Series 34 can only be made by completing an Application Form attached to the Term Sheet Product Disclosure Statement (“TSPDS”), after reading the Term Sheet PDS dated 9 September 2021 and the Master PDS dated 25 March 2020 and submitting it to the Issuer. A copy of the PDS can be obtained by contacting C2 Specialist Investments on 02 8098 0300 or contacting your financial adviser. You should consider the Term Sheet and Master PDS before deciding whether to invest in Units in C2 - Gateway - Series 34. Capitalised terms have the meaning given to them in Section 10 “Definitions” of the Master PDS or in the TSPDS. This information has been prepared by the Issuer for general promotional purposes only and is not an offer to sell or solicitation to buy any financial products. This information does not constitute personal advice and has been prepared without taking into account your objectives, financial situation or needs. You should consider obtaining professional advice as to whether this financial product suits your objectives, financial situation or needs before investing. You should seek independent advice in relation to the tax implications of your investment. The Issuer may, in its discretion, extend or shorten the Offer Period for the Units without prior notice. If this happens, the Commencement Date and one or more consequential dates for the Units may vary. The Issuer may also defer the Commencement Date for the Units, in which case the Maturity Dates and other consequential dates for the Units may vary. If the Issuer varies the Offer Period or the Commencement Date for the Units it will post a notice on this website.

Past Performance Disclaimer

Past Performance Source: Bloomberg/BNP/C2.Past performance is not a reliable indicator of future performance. Data for all charts, graphs and tables related to the BNP Paribas Multi Asset Diversified 5 Index are as of 25 August 2021. Back tested past performance data from 31 December 2002 to 24 January 2016. Live performance since 25 January 2016. Back tested and live past performance data are provided for illustrative purposes only. Back tested and live past performance data should not be regarded as an indication of future results. Performance takes into account deductions for fees and/or costs as specified in the Reference Asset’s index methodology. Further details are available at the Reference Asset website at https://madindex.bnpparibas.com/

Reference Asset Disclaimers

C2 Gateway – Series 34 are not sponsored, endorsed, sold or promoted by any of the BNP Paribas group of companies (“BNP Paribas”), nor does

BNP Paribas have any association or relationship with the Issuer or the Units. BNP Paribas makes no representation regarding the advisability of investing in the Units. BNP Paribas gives no express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use. The Units are issued by the Issuer and marketed by third party dealer groups, they are not sponsored, endorsed, issued, distributed, sold, marketed or promoted by BNP Paribas in any way. BNP Paribas has no obligations or liabilities whatsoever in connection with the Units.

Find out more about C2 Structured Investments

Complete the form below and we'll be in touch as soon as possible.

Subcribe to our monthly newsletter

Covering important superannuation, SMSF, and investment markets commentary

Thanks for subscribing!

Important Information

Get In Touch

- 02 8098 0300

- Send message

- Level 14, 109 Pitt Street,

SYDNEY NSW 2000 - PO Box R1373

Royal Exchange NSW 1225