C2 Gateway Series 1

C2 Gateway Series 1, gives investors the ability to gain leveraged exposure to the performance of the Citi Global Multi-Asset AUD Index (the ‘Reference Asset”) over the 4 year Term with a 100% Limited Recourse Loan at an Interest rate of 2.5%p.a.

.

C2 Gateway Series 1 - Performance

| Price | |

|---|---|

| Starting Price (19 Nov 2018) | 310.60 |

| Coupons | Date |

|---|---|

| 12 Nov 2019 | 4.0517% Net (4.5018% Gross) |

| 12 Nov 2020 | 0.0000% Net (0.0000% Gross) |

| 12 Nov 2021 | 4.5000% Net (5.0000% Gross) |

| 12 Nov 2022 | 0.0000% Net (0.0000% Gross) |

* Indicative Unit Value: Investors, please note this is a theoretical Unit Price, assuming that the Units had reached Maturity. This investment is designed to be held to Maturity. Any investors seeking to redeem prior to maturity may receive an amount significantly different to the Indicative Unit Value stated. Please refer to the PDS for more information about the value of the investment prior to Maturity.

C2 Gateway Series 1 - Description

C2 Specialist Investments allows investors to access investment strategies and structures not readily available to retail investors in Australia. These types of investments are often known as “structured products” and are designed to facilitate highly customised riskreturn objectives.

The Units in C2 - Gateway - Series 1 (“Series 1 Units”) offer investors the ability to gain exposure to the performance of the Citi Global Multi-Asset AUD Index (the “Reference Asset”), the index is published by Citigroup Global Markets Limited (“Citi”) and offers exposure to a core portfolio of global assets including equities, commodities and bonds with the portfolio adjusted algorithmically by Citi according to market trends and the Citi Macro Risk indicator.

Additionally, the C2 Gateway Series 1 Units offer:

- The ability to borrow 100% of the investment amount via a Limited Recourse Loan, at competitive interest rates of 2.5% p.a.

- Potential Coupons:

i) Three potential Coupons of up to 4.5% each at the end of Year 1, Year 2 & Year 3; plus

ii) The potential for an uncapped Final Coupon (less previous Coupons, subject to 10% Performance Fee)

A summary of the key features are as follows

| Series 1 | |

|---|---|

| Reference Asset | Citi Global Multi-Asset AUD Index |

| Currency Exposure | AUD |

| Loan | 100% Loan (Limited Recourse) |

| Annual Interest Rate on Loan | (Prepaid in advance 2.5% p.a. |

| The Potential for 4 Coupons | • Three potential Coupons of up to 4.5% each at the end of Year 1, Year 2 & Year 3; plus • The potential for an uncapped Final Coupon (less previous Coupons, subject to 10% Performance Fee) |

| Application Fee | 2.2% |

| Margin Calls | No |

| SMSF Eligibility | Yes |

Four potential Coupons at the end of Year 1, Year 2, Year 3 and Maturity

You may receive Coupon payments at the end of Year 1, Year 2, & Year 3 of up to 4.5% of the Issue Price per Unit, subject to the performance of the Reference Asset between the Commencement Date and the relevant Coupon Determination Date, and as reduced by a 10% Performance Fee (“Performance Fee”).

You may also receive an uncapped Final Coupon at Maturity (the end of Year 4), subject to the performance of the Reference Asset

(less previous coupons paid), and as reduced by a 10% Performance Fee (the “Final Coupon”).

The Reference Asset: Citi Global Multi-Asset AUD Index Methodology

| The Core Portfolio is comprised of various Global Equities, Commodities and Bonds markets. The Reserve Portfolio can be Bonds or unallocated. Refer to Section 4 for more information about the Core Portfolio and Reserve Portfolio Constituents. |

On a weekly basis, based on the results of market indicators, the Citi Global MultiAsset AUD Index allocates to either the Core Portfolio or the Reserve Portfolio or a combination of the two. | A volatility budgeting mechanism is applied which can reduce the overall exposure of the Index on a daily basis with the view to maintaining the annualised volatility at a level close to 5% |

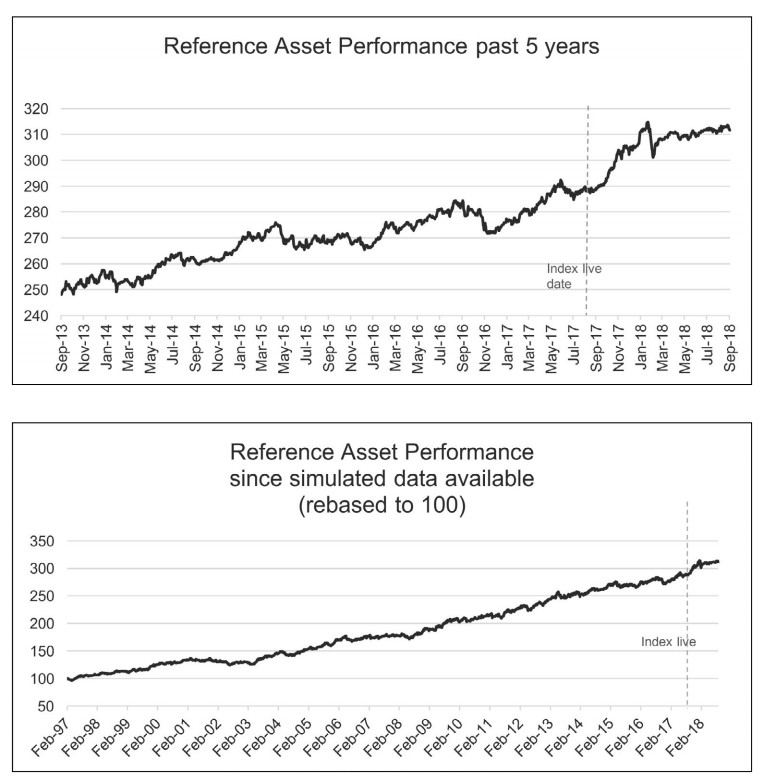

Past Performance

Historical information for the Reference Asset has been provided by the Issuer to potential investors for educational purposes only,

to show investors the history of the Reference Asset. The Reference Asset has been live since 15 August 2017. For the period prior,

commencing 13 February 1997 a simulation was used (13 February 1997 being the earliest published date that simulation data is

available for the market indicators and Core Assets comprising the Reference Asset).

Past Performance is not indicative of likely future performance. Future returns should be expected to vary and may be negative.

Historical Annualised Returns

| 1 year* | Since Live Date* | 3 year# | 5 year# | Since 1997# | |

|---|---|---|---|---|---|

| Citi Global Multi-Asset AUD Index | 7.8%p.a | 7.4%p.a | 5.0%p.a | 4.7%p.a | 5.4%p.a |

*Live data only

# Live data to 15 August 2017, simulated data prior

Source: Bloomberg/Citi/C2. Past performance is not a reliable indicator of future performance. Data for all charts, graphs and tables are as of 07-Sep18. Simulated past performance (back-tested) data from 13-Feb-97 to 07-Sep-18. Live performance of Global Multi-Asset AUD Index since 15 Aug 2017. Simulated and live past performance data are provided for illustrative purposes only. Simulated and live past performance data should not be regarded as an indication of future results. Reference Asset performance takes into account deductions for fees and/or costs as specified in the Reference Asset’s index methodology. Further details are available in links provided in Section 4 “Further Information on the Refence Asset” for Index methodology.

Limitations of Simulated (Back-Tested) Performance Information

All information regarding the performance of the Reference Asset prior to its launch date (17 August 2017) is hypothetical and backtested, as the Reference Asset did not exist prior to that time. It is important to understand that hypothetical back-tested performance information is subject to significant limitations, in addition to the fact that past performance is not a reliable indicator of future performance. In particular:

(a) the hypothetical back-tested performance assumed that there were no market disruption events and no extraordinary events affecting

Reference Asset constituents; and

(b) the hypothetical back-tested performance might look different if it covered a different historical period.

The market conditions that existed during the historical period covered by the hypothetical back-tested performance information is not necessarily representative of the market conditions that will exist in the future.

Certain constituents of the Reference Asset required the use of various proxies as part of the simulation due to the unavailability of certain data sources (meaning a different asset or index approximating a particular constituent was used in place of that constituent for certain time periods). As a result the back-tested performance information may not accurately reflect how the Reference Asset would have performed had the current data sources been available during that time period.

It is impossible to predict whether the Reference Asset will rise or fall. The actual future performance of the Reference Asset may bear no relation to the hypothetical back-tested levels of the Reference Asset.

Find out more about C2 Structured Investments

Complete the form below and we'll be in touch as soon as possible.

C2 Gateway Series 1 - Key Dates

| Timeline1 | |

|---|---|

| Commencement Date / Issue Date | 19 November 2018 |

| First Coupon Payment Date at end of Year 1 | 12 November 2019 |

| Second Coupon Payment Date at end of Year 2 | 12 November 2020 |

| Third Coupon Determination Date at end of Year 3 | 12 November 2021 |

| Fourth Coupon Determination Date at end of Year 4 | 14 November 2022 |

| Maturity Date | 14 November 2022 |

Find out more about C2 Structured Investments

Complete the form below and we'll be in touch as soon as possible.

Gateway Series 1 - Risks

- Your return (including any Coupons) is affected by the performance of the Reference Asset. There is no guarantee that the Reference Asset will perform well.

- No Coupons will be payable if the performance of the Reference Asset is negative at the relevant Coupon Determination Date, or the performance of the Reference Asset is not higher than the sum of any Coupons already paid.

- There is no guarantee that the Units will generate returns in excess of the Prepaid Interest and Fees, during the Investment Term and you could lose some or all of your Prepaid Interest and any Fees paid at Commencement. Additionally, in the event of an Investor requested Issuer Buy-Back or Early Maturity Event, you will not receive a refund of your Prepaid Interest or Fees.

- Gains (and losses) may be magnified by the use of a 100% Loan. However, note that the Loan is a Limited Recourse Loan, so you will never lose more than the Prepaid Interest and any Fees paid at Commencement.

- Investors are subject to counterparty credit risk with respect to the Issuer and the Hedge Counterparty; and the Units may mature early following an Early Maturity Event, including an Adjustment Event, Market Disruption Event or if the Issuer accepts your request for an Issuer Buy-Back.

For more information on the applicable risks, please refer to Section 2 “Risks” of the Master PDS and to the Reference Asset “Plain English Risk Factors” guide published by Citi Here. To find out more information please contact C2 directly on 02 8098 0300 or email [email protected]

Find out more about C2 Structured Investments

Complete the form below and we'll be in touch as soon as possible.

C2 Gateway Series 1 Literature

Find out more about C2 Structured Investments

Complete the form below and we'll be in touch as soon as possible.

C2 Gateway Series 1 - Disclaimer

Units in C2 – Gateway – Series 1 are is issued by C2 Specialist Investments Pty Ltd (ACN 622 433 032) (“the Issuer”) and arranged by C2 Financial Services Pty Ltd (AFSL: 502171. ACN 621 428 635) (“the Arranger”) pursuant to Section 911A(2)(b) of the Corporations Act. Investments in the C2 – Gateway – Series 1 can only be made by completing an Application Form attached to the Term Sheet Product Disclosure Statement (“TSPDS”), after reading the Term Sheet PDS dated 15 September 2018 and the Master PDS dated 12 May 2018 and submitting it to the Issuer. A copy of the PDS can be obtained by contacting C2 Specialist Investments on 02 8098 0300 or contacting your financial adviser. You should consider the Term Sheet & Master PDS’ before deciding whether to invest in Units in C2 - Gateway - Series 1. Capitalised terms in this email have the meaning given to them in Section 10 “Definitions” of the Master PDS or in the TSPDS. This email has been prepared by the Issuer for general promotional purposes only and is not an offer to sell or solicitation to buy any financial products. This flyer does not constitute personal advice and has been prepared without taking into account your objectives, financial situation or needs. You should consider obtaining professional advice as to whether this financial product suits your objectives, financial situation or needs before investing. You should seek independent advice in relation to the tax implications of your investment. The Issuer may, in its discretion, extend or shorten the Offer Period for the Units without prior notice. If this happens, the Commencement Date and one or more consequential dates for the Units may vary. The Issuer may also defer the Commencement Date for the Units, in which case the Maturity Dates and other consequential dates for the Units may vary. If the Issuer varies the Offer Period or the Commencement Date for the Units it will post a notice on the website informing applicants of the change at https://c2financialgroup.com.au/

Past Performance Disclaimer

Past Performance Source: Bloomberg/Citi/C2. Past performance is not a reliable indicator of future performance. Data for all charts, graphs and tables are as of 31 May 2019. Simulated past performance (back-tested) data from 13-Feb-97 to 15-Aug-17. Live performance of Global Multi-Asset AUD Index since 15 Aug 2017. Simulated and live past performance data are provided for illustrative purposes only. Simulated and live past performance data should not be regarded as an indication of future results. Reference Asset performance takes into account deductions for fees and/or costs as specified in the Reference Asset’s index methodology. Further details are available in links provided in Section 4 “Further Information on the ; and (b) the hypothetical back-tested performance might look different if it covered a different historical period. The market conditions that existed during the historical period covered by the hypothetical back-tested performance information is not necessarily representative of the market conditions that will exist in the future. Certain constituents of the Reference Asset required the use of various proxies as part of the simulation due to the unavailability of certain data sources (meaning a different asset or index approximating a particular constituent was used in place of that constituent for certain time periods). As a result the back-tested performance information may not accurately reflect how the Reference Asset would have performed had the current data sources been available during that time period. It is impossible to predict whether the Reference Asset will rise or fall. The actual future performance of the Reference Asset may bear no relation to the hypothetical back-tested levels of the Reference Asset.Refence Asset” of the Term Sheet PDS for Index methodology. All information regarding the performance of the Reference Asset prior to its launch date (17 August 2017) is hypothetical and back-tested, as the Reference Asset did not exist prior to that time. It is important to understand that hypothetical back-tested performance information is subject to significant limitations, in addition to the fact that past performance is not a reliable indicator of future performance. In particular: (a) the hypothetical back-tested performance assumed that there were no market disruption events and no extraordinary events affecting Reference Asset constituents

Reference Asset Disclaimers

Citi is a registered trademark and service mark of Citigroup Inc. or its affiliates and is used and registered throughout the world. C2 Gateway – Series 1 (“the Units”) are not sponsored, endorsed, sold or promoted by Citigroup, and Citigroup makes no representation regarding the advisability of investing the Units. Citigroup gives no express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use. In no event shall Citigroup be liable for any direct, indirect, special or consequential damages in connection with any use of the Citigroup data and information.

Find out more about C2 Structured Investments

Complete the form below and we'll be in touch as soon as possible.

Subcribe to our monthly newsletter

Covering important superannuation, SMSF, and investment markets commentary

Thanks for subscribing!

Important Information

Get In Touch

- 02 8098 0300

- Send message

- Level 19, 25 Bligh Street,

SYDNEY NSW 2000 - PO Box R1373

Royal Exchange NSW 1225