SMSF

Buying Property With a SMSF

Many people are attracted to the greater transparency, choice and control that an SMSF can offer.

Additionally, if you like the idea of directly owning property via your super, then a Self-Managed Super Fund is your only option.

Through our experience dealing with 1000’s of self-directed investors, we have listed what we believe are the 5 main points as to why people want to use their superannuation to buy property:

- They want to have their superannuation exposed to an asset class that they understand and trust – and to avoid the volatility of other asset classes such as shares;

- To access an initial deposit that they would otherwise not have access to;

- To implement tax effective retirement income strategies (think tax free rent and being exempt from capital gains tax – subject to certain limits);

- They want to use their employer superannuation contributions to help fund the ongoing mortgage repayments for their investment property; and

- They want to have an asset that matches their long term investment horizon objectives – property generally ticks this box.

I was introduced to C2 from an investment group that I was involved in. C2 Super has been extremely helpful and their advice & service has been on the money for the past 7 years. I would happily recommend C2 Super’s services to anyone looking to buy property with a SMSF.

Janice and Darren Polson, Melbourne

Have a question about SMSF Property Investment?

Get in touch with one of our dedicated SMSF Consultants today.

Find out more about SMSF Property Investment

Complete the form below and we'll be in touch as soon as possible.

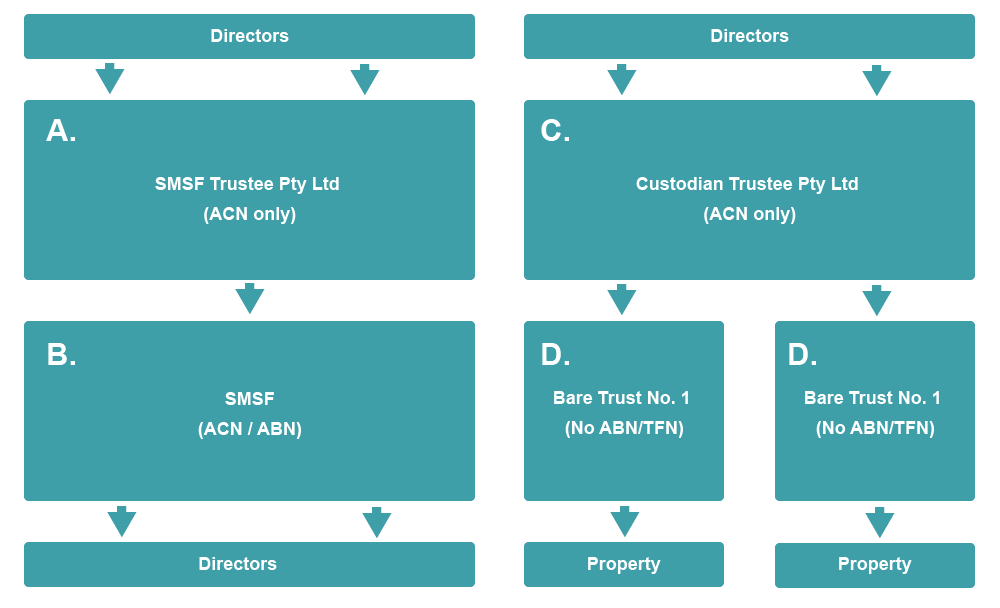

The property must be held in a specially designed trust commonly called a ‘Bare Trust’.

When entering into a property transaction with your SMSF that involves taking out a loan to fund the purchase of the property, the superannuation legislation clearly states the property must be held on trust for the benefit of the trustees of the SMSF.

Why is a bare trust required? The policy thinking behind why the property must be held on trust for the SMSF is a protection policy for SMSFs. It removes the property from the other assets of the SMSF, thereby protecting the other SMSF assets from any potential litigation or lender claims that may arise in conjunction with the property.

C. Holds legal title of the property for the benefit of the SMSF Trustee. It is also the purchasing entity on the contract of sale.

B. The SMSF is registered with the ATO. Bank account D. opened in the name of the SMSF. Rent is received and interest and expenses are paid to and from the bank account. All business activity happens through the SMSF.

D. The Bare Trust(s) describes and enforces the relationship between C, A and B.

What if I don’t want to use a loan, do the same rules and structures still apply?

No – the rules are very much relaxed when you are not borrowing to purchase a property in super. There is no need to hold the property in a bare trust, the property is simply purchased and held in the name of the SMSF e.g. John Smith Pty Ltd ATF The John Smith SMSF.

There are also no restrictions around improving the property, for example sub-dividing a residential property and putting two brand new houses on the block of land is allowable, or even converting it to a different class of asset, such as a commercial premises, will not contravene the SMSF borrowing rules.

Have a question about SMSF Property Investment?

Get in touch with one of our dedicated SMSF Consultants today.

Find out more about SMSF Property Investment

Complete the form below and we'll be in touch as soon as possible.

One of the key rules when borrowing through an SMSF is that the loan must be made on a ‘limited recourse basis’.

What this means is that the lender’s recourse (i.e. the debt recovery action the lender can take against the borrower) must be limited to the asset that is the subject of the loan.

A Limited Recourse Loan must only be used to buy a Single Acquirable Asset. It is very important that SMSF trustees understand what these terms mean and how they are applied, especially if you are considering doing renovations or property developments within your SMSF.

For a more technical insight into the rules around borrowing in super, including the Limited Recourse Borrowing Arrangement (LRBA) and Single Acquirable Asset rules, see chapters 4 and 6 in our ebook.

Related Party Loans

It is possible for a related party of an SMSF to lend directly to their SMSF, rather than going to a bank for a loan. However, there are some strict criteria that the ATO has put in place to make sure that the loan is done on an ‘arms length basis’. Additionally, SMSFs need to make sure they comply with all other regulatory requirements, such as the Sole Purpose Test, related party purchases rules, in house asset rules and SMSF borrowing required structures to name a few.

Essentially, you have two options when you, or a related party, is going to lend directly to your SMSF;

You can match the terms of an existing commercial loan available that you could have, and would have, been able to obtain (see TD 2016/16). You can follow the ATO’s safe harbour guidelines. (see ATO PCG 2016/5) Essentially, these guidelines map out that the terms of the loan must be:

- 15 years

- Principal and interest repayments

- 5.94% interest rate (changes annually, current as at 1 July 2019)

- 70% LVR or less

- Mortgage in favour of the lender over the property

- It must be a written agreement.

Most trustees opt for the 2nd option, as complying with the safe harbour provisions usually results in no auditing questions or issues.

Want to find out how to structure a related party loan to your SMSF, including repayment schedule calculations?

Please get in touch with one of our specialist SMSF consultants.

Find out more about SMSF Property Investment

Complete the form below and we'll be in touch as soon as possible.

5 Common Taxes seen by SMSFs

Your SMSF tax rates vary depending upon whether your SMSF is in Accumulation Phase or Pension Phase. Generally speaking, when your SMSF is Accumulation Phase you are still working and you have not yet reached retirement age. When your SMSF is in Pension Phase you have typically stopped working, or reached an age set out in legislation allowing you to start pulling out money from your SMSF.

When your SMSF is in Accumulation Phase the following taxes apply:

1. Income Tax

15% is the tax rate for net income earned by SMSFs. The following are some common categories of income that attract a 15% tax liability in an SMSF:

- Employer Contributions

- Rent received

- Interest earned

- Dividends and distributions

2. Expenses

Just like your personal income tax returns, when you are calculating how much income tax your SMSF is liable for, you first work out your total income, subtract allowable deductions and then multiply the resulting amount by the relevant tax rate (i.e. 15%). The following are some common deductions available to SMSFs owning direct property:

- Interest expense on mortgages

- Body corporate fees

- General repairs

- Accounting and Auditing fees

- Legal fees (except when they’re of a capital nature)

- Bank charges

- Depreciation

- Life and TPD (Total and Permanent Disability) insurance premiums and fees

3. Capital Gains Tax

Capital gains are also taxed at 15%, unless the property has been held for more than 12 months, where the rate of tax drops to 10%. For example, if your SMSF purchased a property for $500,000 and sold it 13 months later for $600,000, the profit of $100,000 would be taxed at 10%, i.e. $10,000 tax payable (assuming no other capital expenses were available to lower the profit).

4. Stamp Duty

That annoying tax that is impossible to avoid. It doesn’t matter if your SMSF is in Accumulation Phase or Pension Phase. Unfortunately just because you are buying a property through your SMSF the Offices of State Revenue (OSR) around the country provide no relief for this tax.

This is a state-based tax, as such the amount that will be payable upon purchase will be dependent upon what state the property is located. Every state provides information on their websites about current rates of Stamp Duty.

5. Land Tax

As with its ugly sister Stamp Duty above, Land Tax is also a state-based tax that is charged whether or not your SMSF is in Accumulation or Pension Phase. Unless of course you are buying the property in the Northern Territory – they do not have land tax in the Top End.

Land tax is charged on the value of the land associated with the property. Most states offer a threshold value that must be met prior to land tax being charged (for example in NSW the current land tax rate threshold is $432,000, above this amount and a tax rate of 1.6% p.a. is charged). Grouping also applies to land tax; for example if you owned 2 investment properties in NSW where the land was worth $250,000 each, you would be liable to pay land tax based on the excess $68,000 above the threshold.

In practice though, this tax is often not charged to SMSFs for the following two reasons:

- SMSF Trustee soften buy apartments as the rental yields are typically higher (making serviceability easier). The underlying land value for each apartment is usually quite low and therefore doesn’t usually exceed the land tax threshold.

- SMSFs are generally NOT grouped with other properties you already own in that state. For example, in the above example if you owned one property in your own name worth $250,000 land value, and your SMSF owned another with a $250,000 land value, neither yourself nor your SMSF would be liable for land tax as they are not grouped together and individually each falls under the $432,000 threshold. In most situations, if you compare these taxes against buying property in any other entity that you may have, it is very likely that you will have to pay these taxes discussed above and potentially at a higher rate.

Tax concessions are one of the major reasons why SMSF trustees look to buy property with an SMSF.

The Zero Tax Zone

Once you convert your SMSF to Pension Phase, all income and capital gains is taxed at 0%!* This is a huge advantage that SMSFs have over all other types of holding vehicles.

The two most common ways we see people taking advantage of this are:

- Properties that are earning rent. Once the SMSF is converted into Pension Phase, all rent received into the SMSF is tax free. The SMSF can then pay out a tax free income to the member of the SMSF (assuming the member is over 60).

- Selling a property and not having to pay capital gains tax. This is a great trick to avoid CGT. Let’s say you purchased a property in your SMSF for $500,000 when you were 50 and held onto it for 10 years (assuming you retired at 60) or 15 years (assuming you kept working to at least 65). Your SMSF sold the property for $1 million, realising a gain of $500,000. If you convert your SMSF to pension phase prior to selling this asset, you will pay ZERO Capital Gains Tax. If you had of held this property in your own personal capacity, you would have to pay your marginal rate of tax on $250,000 profit (after applying the CGT discount of 50%), meaning for most people, this would be a tax saving of around $100,000- $125,000 by holding the property in your SMSF!

*Subject to the $1.6million transfer balance cap

Want to find out more about buying a property with your super?

Please get in touch with one of our specialist SMSF consultants.

Find out more about SMSF Property Investment

Complete the form below and we'll be in touch as soon as possible.

10 Common Mistakes When Buying Property With Your SMSF

Many trustees make mistakes, especially when they are just starting out. Here are some of the most common mistakes made by trustees and how you can avoid them. At C2 Super we pride ourselves on this knowledge to make sure that you don’t fall into the same traps.

1. Purchasing residential property from a related party.

You would be surprised at how often this happens. The most common example is people buying personal investment properties from themselves. You cannot do this. The consequences are quite severe as well, as in addition to the potential fines imposed by the ATO for non-compliance, you will also get stung with stamp duty, not once, but twice. Firstly when your SMSF buys the asset, and secondly when you have to fix the problem and move the property back to your personal name.

2. Paying off your personal investment property using SMSF funds.

The common excuse for this mistake is that the trustee will say their personal investment property is for their retirement and, as such, they took money from the SMSF bank account to cover a few monthly mortgage repayments because they were short on personal funds – and as their SMSF is for their retirement, then there should be no issues, right? Wrong. If you want to use SMSF funds to make mortgage repayments, the property must be beneficially owned by the SMSF.

Making this mistake usually always results in your SMSF Annual Reports being ‘Qualified’, meaning, the ATO are going to come to you for answers and may issue a penalty notice. If you do not fix the problem (i.e. beg for forgiveness and pay back the funds to the SMSF with interest) you’re at a risk of the ATO deeming your fund non-complying.

3. Using residential property for personal use.

As tempting as a holiday house down the coast sounds, do not be tempted to buy one in your SMSF if you plan on using it for personal use. Although this is a hard contravention for SMSF auditors to pick up on (as personal use can be covered up and not reported) the ATO is conducting random inspections on these types of properties. If you do want to get some personal use out of your SMSF property, maybe consider a commercial premises or even a farm – there are some pretty interesting rules around rural property where you can live on the premises while running a business as well (note that lending is very difficult to obtain for this strategy though).

4. Using non-compliant related party loans.

The ATO has recently clarified that it is no longer possible to make a related party loan to your SMSF to buy an asset and for the SMSF to pay zero interest to you. If you are making a personal loan to your SMSF the terms of the loan must also be on commercial terms (and also meet the single acquirable asset rules). The common test to prove if it is a commercial loan is to say if you walked into a bank, would they offer a loan on the same or similar terms? If not, you might want to consider checking with the SMSF auditor what you are planning on doing prior to going ahead and implementing the loan to see if they would have any issues with it. See SMSF Borrowing for more information

5. Breaching the Single Acquirable Asset Rule – Repairing, Maintaining and Improving the Property.

When your SMSF takes out a loan to buy an asset, it must be used only to purchase one asset. This is why it not possible to buy house and land packages, as these types of deals are normally made up of 2 contracts (one for the land and one for the house) and 2 loans (one for the land and a construction loan). The issue is two fold:

a) You can take out a loan to buy the land (so long as you can find a bank that will lend to you to do this. Serviceability for the SMSF often turns banks off lending to buy vacant land blocks), but you cannot then build on the land while it is under mortgage – even with cash reserves in your SMSF. Doing so would change the asset (i.e. it would no longer be a vacant block of land, it would be a block of land with a house on it). This is a breach of the single acquirable asset rules.

b) Secondly, your SMSF cannot get a loan to build a house, even if your SMSF bought the land with cash (i.e. no loan). The reason for this is that the ATO says that a construction contract is made up of 100’s of different items (bricks, windows, wood etc) and as such, you are not buying a ‘single acquirable asset’ with the borrowed monies. If you want to do a project such as this, you would have to have sufficient cash in your SMSF to carry out the project without needing assistance of a loan.

What about Off The Plan Apartments? Off The Plan apartments are different to house and land packages because you are buying a one contract, “turn-key”, asset. You pay a 10% deposit up front and then pay the balance at settlement for the completed project with the assistance of an SMSF loan.

6. Paying rent into personal bank accounts, and not into the SMSFs bank account.

A common that we are asked is “when the tenant pays the rent, does it go to me personally, or does the SMSF get to keep it?” The answer is that the property belongs to the SMSF, so the SMSF gets to keep all income that is generated from it. On the same note, the SMSF is also liable to pay all expenses to do with the running of the property (think interest, rates, water etc). This comes back to the Sole Purpose Test – you are not allowed to get a personal benefit from the SMSF.

7. Buying properties in high risk zones, such as mining towns

C2 Super do not pick or recommend properties. We have seen SMSF trustees buying properties in ‘high risk areas, only for the market to turn and their properties to be well underwater.

People seem to be willing to take more risk with their superannuation money compared to the risk they would normally take with their own funds. As a general rule of thumb, if you don’t think you would make the investment in your own name, you should probably think long and hard about making the investment decision for your SMSF.

8. Purchasing the property in the wrong entity

This is more common than you think. When you first set up an SMSF, there is a feeling of joy – the whole investment universe is now open for you to consider. You are eager, keen and excited to get your teeth stuck into investing in property. You know that your SMSF can do it; you have seen the adverts and your mate at the fishing club has told you that he is doing it too. Here’s how it plays out:

- You turn up to an auction on the weekend to buy the apartment that you have been keeping an eye on, and the price looks right.

- Your funds have been rolled over from your existing super fund to fund the deposit and are sitting in the SMSF bank account. You think you are ready to go.

- The auctioneer calls last bids, you look around and you are the last person with their paddle in the air. The hammer comes down; you are the highest bidder.

- You go to the back of the room and sign the contract of sale in the name of your SMSF.

- You go home, have a glass of wine to celebrate.

- The next day you call up your bank to let them know that you have purchased a property and need to finalise the loan (see below issue on not organising finance prior to signing a contract of sale).

- Everything is going swimmingly until your bank’s solicitors come back and tell you that the current arrangement is in breach of the superannuation legislation because the property has not been purchased by a custodian trustee.

- What do you do?!

- Well, you pretty much have 2 choices.

– Firstly, you can walk away from the deposit and the whole problem disappears, as with the 10% that you put down. Usually not the preferred option.

– Secondly, you can go back to the vendor and beg them to rescind the contract of sale and sign a new one, with the correct entity on it. The reason why you have to rescind and reexecute is that people in this situation often have not set up the second company required to act as custodian trustee. As you cannot backdate the setup of a company (ASIC won’t allow it), if you simply change the purchasing entity on the original contract it will be dated prior to the establishment of the custodian trustee company – obviously this cannot be a valid transaction (i.e. how can a company enter into a transaction prior to it being incorporated?). We suggest giving your conveyancer a call immediately if you find yourself in this situation.

9. Not getting borrowing organised prior to contract signing.

There are 2 scenarios that we have seen where this situation can turn into costly errors.

Firstly, when an SMSF paid a 10% deposit and exchanged contracts without speaking to a Mortgage Broker (or bank) prior. The trustee was under the impression that the SMSF could borrow up to 95% of the sale price, as they had just purchased a property in their own personal capacity, where this was allowed. They got a rude shock when trying to source a loan and it turned out that they could not find a bank willing to lend past 70% for SMSF. So what did they do? Settlement was in 4 weeks. Luckily for this trustee, they had enough capital in their own personal capacity to make a significant non-concessional contribution into their SMSF to add to the purchase price of the property. If they didn’t, they would have lost the deposit as they would not have been able to settle. The key learning point here is to always speak to a qualified mortgage broker to get an idea on your borrowing capacity prior to exchanging contracts.

The second scenario was a bit unlucky for the trustees that got caught up in it. In mid/late 2015 the major banks all tightened their SMSF lending requirements (to comply with new government liquidity and capital requirements) and many of them dropped their LVRs from 80% to 70%. AMP (at the time a major lender in this space) disappeared completely from the sector and withdrew all SMSF lending, only to return to the market 8 months later.

The issue then was that many SMSF trustees had purchased Off The Plan apartments 12-18 months prior to this change and had been given pre-approval for loans based on 80% LVRs. When settlement came around the banks told them they had to contribute an extra 10% to the purchase price to bring the LVR down to 70%. As you can probably envisage, some trustees did not have the extra 10% in their SMSF to meet this requirement (on a $450,000 property, this means having to get another $45,000 into your superfund) and had no choice but to borrow money against their personal homes, businesses, or family members to make the contribution to their SMSFs to meet the higher required deposit amount.

The point to take out of this is that is wise to go into these transactions with a buffer up your sleeve (especially for Off The Plan developments), as you never know when the rules are going to change and catch you off guard.

10. Not having sufficient liquidity in the SMSF to support a pension payment

Let’s assume the SMSF has only one asset, it is a property worth $1 million at the last 30 June valuation. The property has a $500,000 loan against it and as such has only slightly positive cash flow by $10,000 each year (i.e. where rent received is only slightly greater than all outgoings such as interest and costs). The SMSF has 2 brothers as members, one is 65 and the other 55 (both with equal member balances within the SMSF). The older brother decides that he wants to retire and starts pulling some funds out of the SMSF as a pension payment (as he knows that reaching the age of 65 is a ‘condition of release’).

The issue here is as follows:

- The net asset position of the SMSF is that each brother has $250,000 as a member balance.

- The SMSF generates $10,000 per year of excess cash.

- The minimum pension payment for 2016 for someone aged 65 is ‘5% of the net asset position

of their member balance’ (i.e. $12,500). - As such, there is not enough free cash to meet the minimum pension payment requirement for

the older brother. - Not meeting the minimum pension payment in a financial year is a compliance breach for SMSF

trustees and can result in personal fines and potentially result in your SMSF being deemed ‘noncompliant’

by the ATO (often resulting in the removal of all tax concessions that SMSFs enjoy).

How do you fix this? Not easily. The obvious answer is to sell the property. You would then have plenty of liquid cash to meet this minimum payment. However, this isn’t usually the favoured outcome, as the property market might be flat, or the other trustee may not want to sell.

The more common approach would be to get the younger trustee to make a non-concessional contribution to the SMSF to get an extra $2,500 into the cash account of the SMSF, and make the pension payment from this additional cash to the older member so he meets the minimum pension requirement. It is important to point out that the older brother cannot make the contribution to the fund as he is older than 65 and not working – therefore prohibited from making future contributions to the SMSF.

Note: When you make a contribution to an SMSF with more than one member, that contribution gets allocated to you from an accounting angle, however, the exact cash dollars do not – they go into the asset pool. So, in the above example, the brothers owned 50% each before the additional

contribution was made. Once the younger brother made the additional contribution of $2,500, the SMSF had a net asset pool of $502,500, and the younger brothers’ member entitlement would grow to 50.24% of the pool of assets, with the older brother being diluted to 49.76%. So, it doesn’t matter that the cash contribution was made by the younger brother and taken out by the older brother as pension payment, so long as the numbers stack up then this is the easiest strategy to get yourself out of this situation.

Just make sure you sort this out prior to June 30. If you leave it until after this, it will be too late. You cannot back date a pension payment from the bank account.

Want to find out how to structure a related party loan to your SMSF, including repayment schedule calculations?

Please get in touch with one of our specialist SMSF consultants.

Summary of Key Risks

Diversification

For a lot of SMSF trustees, the property may be the only asset the SMSF owns. Not being diversified carries risks, notably, if the property falls in price you can lose potentially all of your invested capital, just like you could if you bought the wrong property in your personal capacity.

Falling property prices

This is a risk that people often (surprisingly) forget about. Property can fall in value. If the property falls in value, your SMSF can be left holding a non-performing investment that you might not be able to sell at a favourable price.

Loss of tenants or loss of employment

When your SMSF is borrowing, it will be required to meet monthly mortgage repayments just like you do in your personal capacity. If for some reason you lose your job, or your SMSF property has a period of no tenancy, there is a risk that you may start defaulting on your repayments which may require you to sell the property at an unfavourable price to satisfy your loan agreement with the lender.

Leverage

You may have heard the expression that leverage can be a double-edged sword. When borrowing to buy an asset, whether it is in super or in your personal capacity, leverage can potentially magnify both gains and losses.

Liquidity

One of the key requirements for SMSF trustees is that they must be able to meet the ongoing running costs of the SMSF (whether it be fees or pension payments). If you have all of your money locked away in an illiquid property investment (and you are unable to make cash injections into the SMSF) you may be forced to sell the property at a loss, or at a less opportunistic price, to meet these requirements.

Ongoing documentation requirements

It can become quite onerous for SMSF trustees to keep up with all the initial and ongoing paperwork to make sure your SMSF stays compliant. A specialist SMSF provider such as C2 Super can help you overcome these issues.

Tax risk

The Government is always changing the rules when it comes to superannuation, so be prepared for changes that may affect your SMSF strategy – for the good or the bad.

Want to find out how to structure a related party loan to your SMSF, including repayment schedule calculations?

Please get in touch with one of our specialist SMSF consultants.

Find out more about SMSF Property Investment

Complete the form below and we'll be in touch as soon as possible.

1. C2 Application Form

Firstly, to buy direct property using your superannuation you need to establish an SMSF. To setup an SMSF please contact us to book a free phone or face-to-face meeting and to be sent the appropriate application forms using the contact us form on this page.

2. Obtain loan preapproval for your SMSF

Get an idea on how much your SMSF might be able to borrow and obtain some sort of preapproval. As part of our network, we have experienced mortgage brokers who can give you an idea on the amount you could borrow to buy a property within an SMSF.

3. SMSF & SMSF Trustee Company Establishment

Once you decide to go ahead and your application form has been received, C2 Super will organise the trust deeds, company establishments, bank accounts and personal insurance if requested (such as life/TPD/Income protection).

4. Rollover of your existing superannuation to your SMSF

Once the SMSF has been established you will need to roll over your existing superannuation money into your SMSF. C2 can assist you in this process.

5. Source the property

Once you have decided on your investment strategy and obtained your preapproval from the lender, you source the property that you want to buy and appoint a conveyancer to assist you through the contract work/negotiation.

6. Establish Property Trust & Property Trust Trustee Company

Once you have found the investment property, you need to establish a special holding trust called a bare trust as well as the custodian trustee company. C2 Super will assist in creating these for you.

7. Final loan approval & vetting of documents

Once the bare trust has been established, the bank will give formal loan approval and vet the legal documents.

8. Property Settlement

Finally the property is settled! You can feel safe in knowing that your hand will be held the whole way through the journey. C2 Super will then facilitate ongoing administration and compliance services for your SMSF (such as annual preparation of tax returns, financials and audit).

Have a question about SMSF Property Investment?

Get in touch with one of our dedicated SMSF Consultants today.

Find out more about SMSF Property Investment

Complete the form below and we'll be in touch as soon as possible.

Download your free copy of Buying Property With Your SMSF

by John Collignon, CEO, C2 SUPER

Free SMSF Property Consult with ebook Download!

Inside you will discover:

- How to know if an SMSF is right for you

- What is required of SMSF trustees (critical information for anyone involved with an SMSF)

- Structures required to buy property using an SMSF

- How to buy Rural Property in your SMSF

- How to do a property development in your SMSF

- 10 Common mistakes made by SMSFs when buying property

- How to pay ZERO capital gains and income tax on your SMSF investment property

We found this Ebook a brilliant and simple read, covering off the most important topics to do with buying property with your SMSF. We have now been clients with C2 Super for almost 4 years and highly recommend their services to anyone that is interested.

Joel K & Bianca B. Alex Heads, QLD.

Get Instant Access!

Simply complete the form below to gain immediate access to Buying Property With Your SMSF.

Subcribe to our monthly newsletter

Covering important superannuation, SMSF, and investment markets commentary

Thanks for subscribing!

Important Information

Get In Touch

- 02 8098 0300

- Send message

- Level 19, 25 Bligh Street,

SYDNEY NSW 2000 - PO Box R1373

Royal Exchange NSW 1225